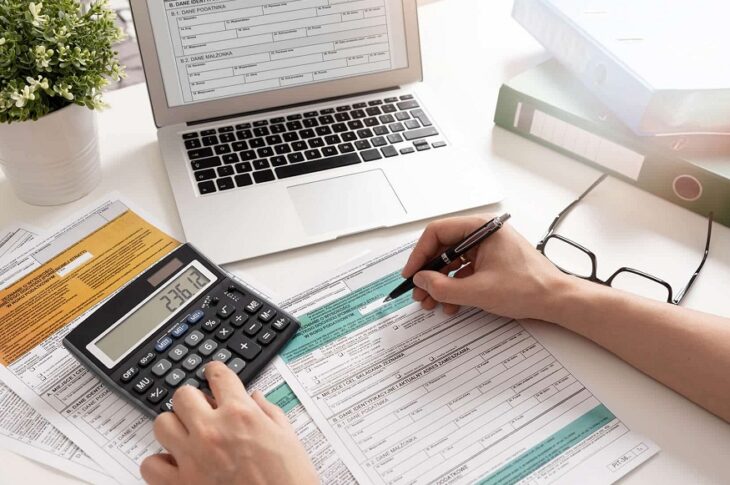

Top Tax Deductions That US Freelancers Often Overlook

January 27, 2025

What Are Dubai’s Top Interior Design Companies?

January 6, 2025

Year-End Tax Strategies – Key Tips to Save Money

January 3, 2025

From Invoices to Income: Bookkeeping Essentials for Freelancers

December 28, 2024

Quick Tips to Choose the Right Restaurant Uniforms

December 13, 2024

Do you need to submit a FATCA Form 8938 or an FBAR Form Fincen114?

December 13, 2024

How Predictive Modeling Be Helpful For Accounting Firms?

November 30, 2024