International CFD Trading Platforms: Comparing Options for Traders

Contracts for Difference (CFD) trading has emerged as a popular way for traders to access a wide range of financial instruments without owning the underlying assets. With its global reach, CFD trading allows individuals to speculate on the price movements of stocks, commodities, indices, and even cryptocurrencies. This article explores the ins and outs of CFD trading platforms, comparing different international options available to traders. We will cover essential factors to consider when choosing a platform, provide a comparative analysis of the leading platforms, and offer guidance on how to select the best one based on your needs.

What Are CFD Trading Platforms?

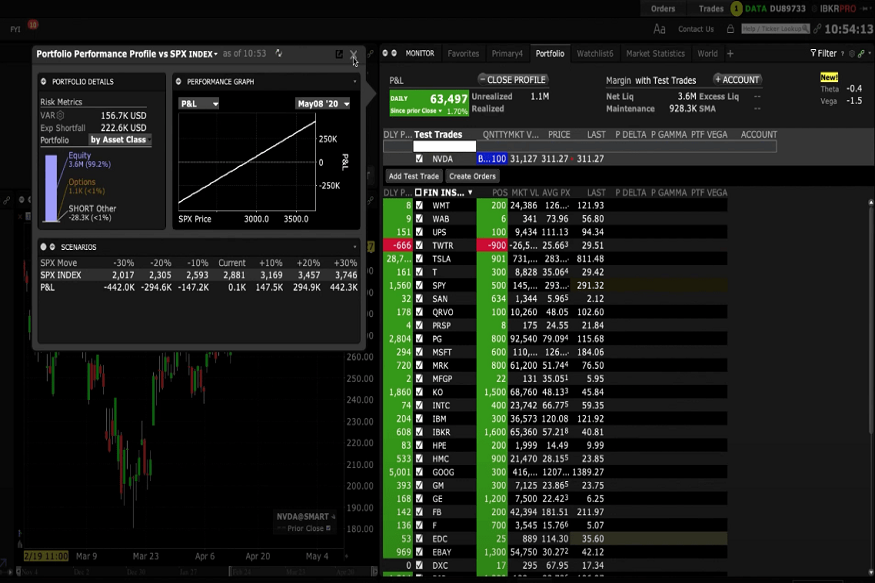

A CFD trading platform is a software tool that enables traders to engage in CFD trading. These platforms provide access to various financial markets, allowing traders to speculate on the price movements of assets like shares, commodities, indices, and forex. Unlike traditional investing, traders do not own the underlying assets in CFD trading. Instead, they enter into contracts with brokers to profit from the differences in the price of the asset between the opening and closing of the contract.

These platforms are designed to provide traders with all the necessary tools to execute trades, manage risk, and monitor their positions. Most platforms offer advanced charting tools, technical indicators, and customizable interfaces. Additionally, CFD trading platforms often support features such as demo accounts for practice trading and leverage, which allows traders to control larger positions with a smaller capital investment. Explore adss.com for more information.

Factors to Consider When Choosing a CFD Trading Platform

Regulation is one of the most critical factors in choosing a CFD trading platform. Reputable regulatory bodies such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC) oversee trading practices to ensure that platforms operate fairly and transparently. Platforms that are licensed by such bodies provide a higher level of security and accountability for traders. When trading on an unregulated platform, traders may face higher risks, including potential fraud or exploitation, as there is no oversight to ensure fair practices. It’s important to verify that the platform you’re considering complies with regulations in your region and that it has a good track record.

Understanding the costs associated with CFD trading is essential, as these can significantly impact profitability. Trading costs include spreads, commissions, overnight fees, and other potential charges. The spread refers to the difference between the buying and selling prices of an asset. Some platforms offer fixed spreads, while others have variable spreads that change depending on market conditions. Commissions may apply to certain types of trades or accounts, and overnight fees are charged for holding positions open beyond the trading day. These costs can add up, especially for short-term traders who frequently open and close positions. It’s important to compare the fee structures of different platforms and determine how they align with your trading strategy.

How to Choose the Right CFD Platform for You

Selecting the right CFD platform depends on several factors, including your trading goals, experience level, and geographical location. Begin by assessing your trading needs—are you looking for a platform with low fees, advanced features, or social trading capabilities? Once you have a clear idea of what you want, compare the options available and consider factors like regulation, asset availability, and leverage.

Many platforms offer demo accounts, which allow you to practice trading with virtual funds before committing to a live account. This is an excellent way to test out a platform’s features and functionality without risking real money.

Risks and Challenges in CFD Trading

While CFD trading can be highly profitable, it also carries significant risks. One of the biggest challenges is the use of leverage, which can magnify both gains and losses. High leverage allows you to control a larger position with a smaller amount of capital, but it also increases the risk of losing more than your initial investment.

Market volatility is another challenge, as price fluctuations can be rapid and unpredictable, leading to significant losses if not properly managed. Liquidity risks can also affect CFD pricing, particularly in less liquid markets, where the price of an asset may not reflect the true market value.

Conclusion

Choosing the right CFD trading platform is a crucial decision for any trader. With the wide variety of platforms available, each offering different features, costs, and asset selections, it’s important to carefully consider your trading needs and preferences. Whether you’re an experienced trader seeking advanced tools or a beginner looking for an easy-to-use platform, there’s a CFD trading platform that suits your requirements. Before committing to a platform, always take advantage of demo accounts to practice trading and test the platform’s functionality. And remember, successful CFD trading requires both technical knowledge and strong risk management practices.